STP. It’s payroll. Just faster.

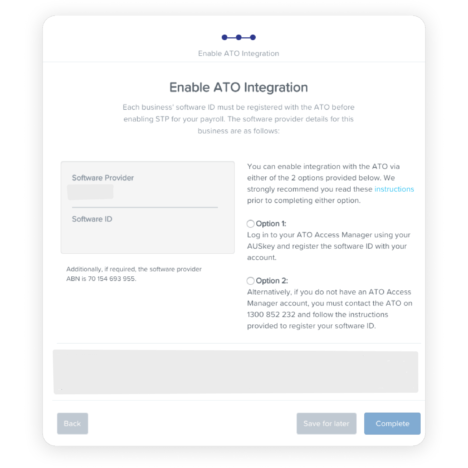

ATO compliance has never been easier

Minimise STP errors

Enjoy peace of mind over STP Phase 2

Keep Single Touch Payroll simple in 3 steps.

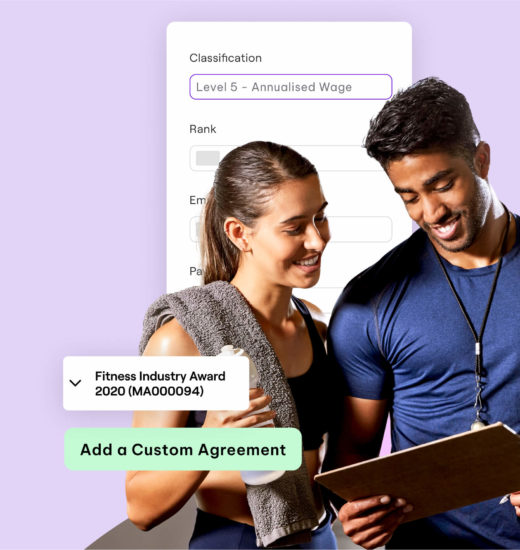

Handle STP Phase 2 reporting requirements with ease.

Mandatory termination

Save time by selecting a termination reason from a dropdown list.

Voluntary reporting of child support

Opt to report via STP to eliminate the need for providing separate monthly reports to the Child Support Registrar.

TFN declaration reporting

Streamline processes by submitting tax file declarations via STP reporting. No need to manually lodge these with the ATO, as pay events will report every included employee’s tax information.

Disaggregation of gross & Phase 2 reporting

Easily assign payment classifications to pay categories via a dropdown list of pre-populated options.

Income types and country codes

Streamline reporting by assigning an income type (and country code, if required) for each payment made to an employee.

Effortless payroll. The way it should be.

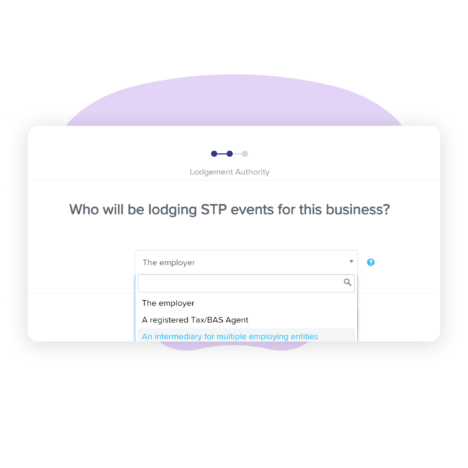

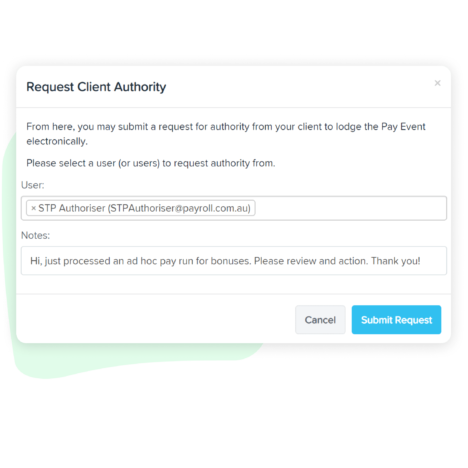

Tax/BAS Agents can get client approval to manage pay events on the platform, without the need for external emails. All client actions are tracked within the STP event. Agents with Standing Authority can use it against an event, eliminating the need for repeated client authority approval.

Innovation, reliability, customer service.

A tick, gold medal, five stars.

over the past year

Made by payroll experts. For payroll experts.

Resources. All for you.